Page 36 - CURAJ Information Handbook for SC ST Cell

P. 36

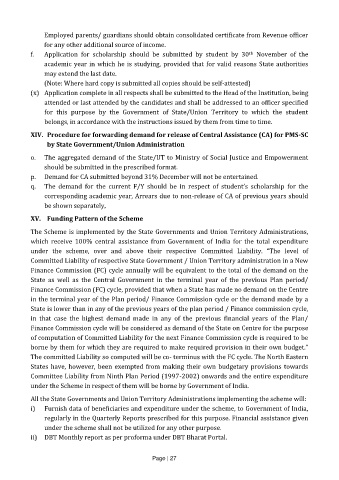

Employed parents/ guardians should obtain consolidated certificate from Revenue officer

for any other additional source of income.

f. Application for scholarship should be submitted by student by 30 November of the

th

academic year in which he is studying, provided that for valid reasons State authorities

may extend the last date.

(Note: Where hard copy is submitted all copies should be self-attested)

(x) Application complete in all respects shall be submitted to the Head of the Institution, being

attended or last attended by the candidates and shall be addressed to an officer specified

for this purpose by the Government of State/Union Territory to which the student

belongs, in accordance with the instructions issued by them from time to time.

XIV. Procedure for forwarding demand for release of Central Assistance (CA) for PMS-SC

by State Government/Union Administration

o. The aggregated demand of the State/UT to Ministry of Social Justice and Empowerment

should be submitted in the prescribed format.

p. Demand for CA submitted beyond 31% December will not be entertained.

q. The demand for the current F/Y should be in respect of student’s scholarship for the

corresponding academic year, Arrears due to non-release of CA of previous years should

be shown separately,

XV. Funding Pattern of the Scheme

The Scheme is implemented by the State Governments and Union Territory Administrations,

which receive 100% central assistance from Government of India for the total expenditure

under the scheme, over and above their respective Committed Liability. “The level of

Committed Liability of respective State Government / Union Territory administration in a New

Finance Commission (FC) cycle annually will be equivalent to the total of the demand on the

State as well as the Central Government in the terminal year of the previous Plan period/

Finance Commission (FC) cycle, provided that when a State has made no demand on the Centre

in the terminal year of the Plan period/ Finance Commission cycle or the demand made by a

State is lower than in any of the previous years of the plan period / Finance commission cycle,

in that case the highest demand made in any of the previous financial years of the Plan/

Finance Commission cycle will be considered as demand of the State on Centre for the purpose

of computation of Committed Liability for the next Finance Commission cycle is required to be

borne by them for which they are required to make required provision in their own budget.”

The committed Liability so computed will be co- terminus with the FC cycle. The North Eastern

States have, however, been exempted from making their own budgetary provisions towards

Committee Liability from Ninth Plan Period (1997-2002) onwards and the entire expenditure

under the Scheme in respect of them will be borne by Government of India.

All the State Governments and Union Territory Administrations implementing the scheme will:

i) Furnish data of beneficiaries and expenditure under the scheme, to Government of India,

regularly in the Quarterly Reports prescribed for this purpose. Financial assistance given

under the scheme shall not be utilized for any other purpose.

ii) DBT Monthly report as per proforma under DBT Bharat Portal.

Page | 27